|

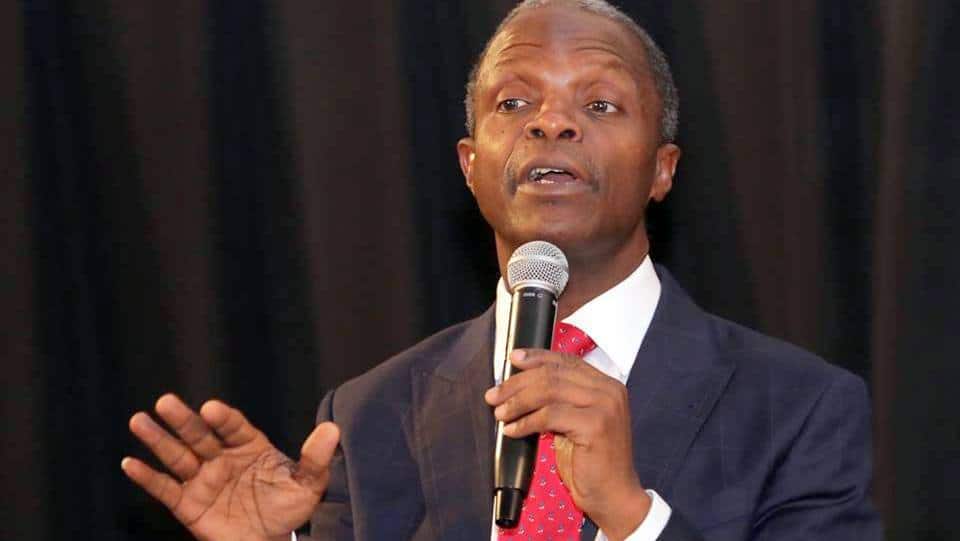

| Vice President of Nigeria, Professor Yemi Osinbajo |

Mr Osinbajo who disclosed this while fielding questions from a cross-section of women traders at a programme tagged `Next Level Conversation’ in Abuja yesterday said that the federal government decided to establish an Entrepreneur Bank to provide flexibility in the provision of facilities to businesses.

The women, who were mostly entrepreneurs, were drawn from the education, environment, agriculture, real estate, hospitality among other sectors.

The vice president said the issue of giving cheap loans to small businesses had featured prominently in the President Muhammadu Buhari-led administration.

“We have been able to deal with some extent with small and micro businesses; we have TraderMoni, MarketMoni, FarmerMoni; which are basically very small credit schemes.“We are also looking at an Enterprise Bank or an Entrepreneur Bank which is one of the types of establishment we are looking at.

“We think there is a need for a bank that will be a bit more nimble about entrepreneurship; a bank that has a bit more flexibility.

“That is why we are talking about Entrepreneur Bank; of course, we will need a bill in the National Assembly. In the meantime, we think we can start with a bond to put a lot around it without necessarily building another big bureaucracy,’’ he said.

Mr Osinbajo said there was the need to properly fund education as efforts were being made to get the Tertiary Education Trust Fund (TETFund) to also fund the private sector.

He reiterated the challenge of funding education with the federal, state and local governments. The vice president added that the federal government would collaborate with state and local governments to curb multiple taxations which had an adverse effect on businesses.

Comments

Post a Comment